In Malaysia, we are greeted with a plethora of eWallet choices to execute our payments with such as Grab, Boost, Touch N Go eWallet, and Fave which are amongst the bigger players in the market. These eWallets are great as they simplify payments without the need of physical cash and being very simple to use, so simple that teenagers are able to use it anytime. However, amongst these eWallets in Malaysia, I’m gravitating towards GrabPay.

I first got the opportunity to explore deeper into GrabPay after noticing a friend of mine in university who likes transferring money through Grab, which pique my interest on why she is willing to lock up money within that app. And so I dig…

Grab Rewards You To Use Grab

Grab has introduced the Grab Rewards Points (GRP) alongside GrabPay in the year 2017 which incentivises users when they transact with their app, be it for GrabCar services or payment to a merchant at that time.

Throughout these years, Grab has organized campaigns which incentivizes users even more by using GrabPay within the campaign period. Fast forward today, it isn’t happening that often anymore (which I’ll touch on why further down)

Grab rewards users based on their tiers such as Member, Silver, Gold and Platinum. So, if you’re in a higher tier, you earn more GRP for every RM1 transacted through the app, be it through GrabCar, GrabPay or even GrabFood.

How do you climb your way up to different tiers? By spending and accumulating points, you would be qualified to different tiers when you hit a certain amount of points as below:

Tier | GRP Needed to Qualify |

|---|---|

Member | 0 |

Silver | 200 |

Gold | 900 |

Platinum | 3500 |

Using Rewards Points

So you got your rewards points, how do you use it? There are mainly 2 ways to utilizing your points, either by redeeming vouchers or saving some money with them.

Grab has been able to partner with a wide variety of merchants to allow users to claim cash vouchers of different merchants such as Haagen-Daz, Baskin Robbins, FamilyMart or you may even opt for vouchers on other Grab services. Usually you would be able get a RM5 voucher with 800 GRP, which averages around 160 GRP for RM1. Every now and then, there are “discounts” on vouchers where you’d expend lesser point for the same voucher.

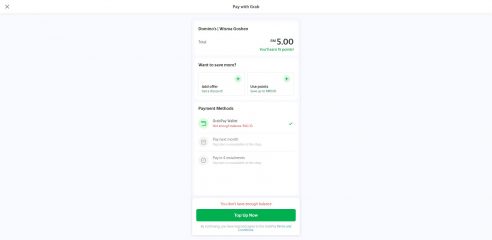

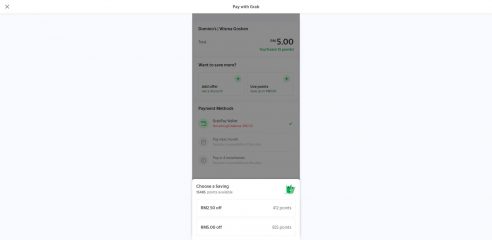

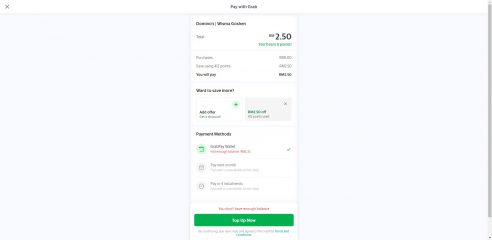

On the other hand, if you do not fancy using vouchers or your favorite merchant does not have any vouchers on the Grab app, you could try saving some money while making payments on the Grab app by “burning” your accumulated GRP. This can be done when you make payment after scanning Grab issued DuitNow QR code, or on sites that have GrabPay integration, or even save on other Grab services like GrabFood, GrabCar or GrabExpress. These rebates usually averages to 165 GRP for every RM1 savings.

Paying through QR Scan

Pay Through Grab App/ Integrated Websites

Supercharge Your Grab Experience

Now that you know how everything works and you’re thinking of giving it a try, but it seems to you that the journey to being in a Platinum tier seems like an arduous path, it would need you to expense RM600 just to get to Gold tier and another RM1066 to get to the Platinum tier, which amounts to RM1666. Crazy huh?

In 2020, Maybank and Grab announced a collaboration to launch the Maybank Grab Mastercard Platinum Credit Card and this is the tool that will supercharge your experience. By using this card in tandem with GrabPay, you’d be getting x8 GRP for every RM1 transacted through Grab. How, you may ask? Let’s break it down.

By integrating your Grab Maybank Credit Card with the Grab app, you get x5 GRP for every RM1 reloaded onto the app, you’re already rewarded just by putting money into the app while paying nothing with it. Secondly, upon activation and linking of credit card with the Grab app, you’d be upgraded to the Platinum tier for the next 6 months, so every RM1 that is transacted will earn you another x3 GRP.

So in short, reloading RM20 earns you 100 GRP, then pay something through the Grab app and you get another 60 GRP. That’s 160 GRP for RM20 worth of your money compared to just 60 GRP if you were to not use Grab with the credit card.

Alongside the benefit of tier upgrade and having higher Grab Rewards Points multiplier, you get 1000 GRP as a welcome gift. What’s more? You’re reaping benefits as a credit card user by building your credit score too.

How much do you need to qualify for the Platinum Tier after the 6 month upgrade period? With the 1000 GRP welcome gift, you’d just need to get another 2500 GRP to be in the platinum tier. Dividing 2500 GRP by 8, you’d be looking at just 312.50 to achieve that goal of enjoying x3 GRP in the future. That’s nearly 70% of savings compared to the “traditional route”.

5% Cashback You Say?

Here’s where it gets juicy in my opinion, remember how you’re able to convert 165 GRP to RM1 of savings while transacting through the Grab app?

Let’s do some basic math:

Spending RM21 earns you 168 GRP, where 165 GRP earns you RM1 in savings. So you’re getting 1/21 = 4.76% (~5%) of cashback on almost everything you spend, regardless of category.

I admit that 5% does not seem like much, but it’s still nice to have. There are indeed credit cards that boast a higher cashback amount, but most of them usually cap your maximum cashback amount, while limiting what categories you’re allowed to spend on to qualify for that said cashback and requiring a minimum monthly transaction amount. If the credit card aligns with your lifestyle and you’re able to meet that minimum amount, I’d say that is definitely the better choice for you. On the other hand, if you don’t think you’d be able to get the most out of Cash Back Credit Cards by other banks, you could consider Grab as a choice.

Not All Payments on Grab Are Equal

DuitNow QR has unified payments through QR for Malaysians, where a merchant’s QR code can be used with either GrabPay, Boost, ShopeePay or Touch N Go eWallet. Certainly it provides simplicity for the customer’s end, but do note that DuitNow QR not issued by Grab (as shown in image below) do not qualify for Grab Rewards Points.

Closing Thoughts

With the pandemic around us, it has accelerated the digitisation of the world around us and payment is one of them, where we are transacting physically lesser with cash anymore. I do see a future where even the hawker store near you would accept GrabPay as a form payment, which allows you to collect GRP even on day to day expenses. I believe in the future we no longer need cold hard cash anymore and these ewallets get standardize as the form of payment, and I see Grab taking a huge market share with its direction to being a super app.